Free download.

Book file PDF easily for everyone and every device.

You can download and read online Back On Top file PDF Book only if you are registered here.

And also you can download or read online all Book PDF file that related with Back On Top book.

Happy reading Back On Top Bookeveryone.

Download file Free Book PDF Back On Top at Complete PDF Library.

This Book have some digital formats such us :paperbook, ebook, kindle, epub, fb2 and another formats.

Here is The CompletePDF Book Library.

It's free to register here to get Book file PDF Back On Top Pocket Guide.

Back on Top is the fifth studio album by folk punk band The Front Bottoms. It was released on September 18, , on Fueled by Ramen, their first for the label.

Table of contents

- Control Google Nest or Google Home devices by touch

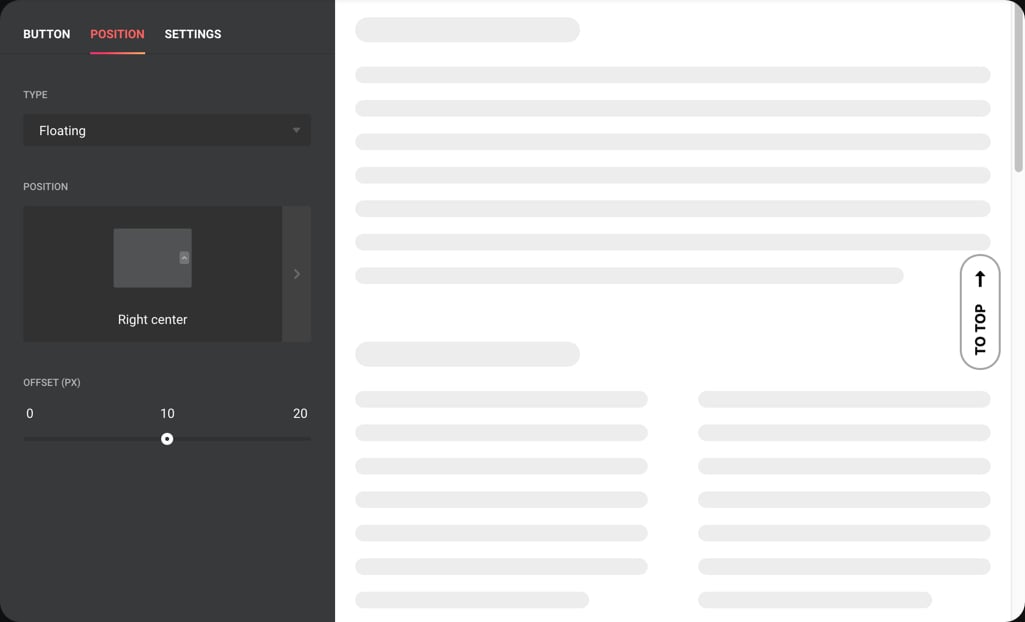

- How TO - Scroll Back To Top Button

- Support links

- Stow Back On Top

- AZLyrics - request for access

To choose a credit card, start by determining what type of card you want. You can figure this out by asking yourself why you're getting a new card. Common reasons include cash-back rewards, travel benefits, credit building, or balance transfers.

Control Google Nest or Google Home devices by touch

Focus on features that will be easy for you to use, as those will provide you with the most value. Continue narrowing down the results until you've found the card that's right for you. There's no right or wrong number of credit cards, but the smart approach for most consumers is to take it slow and aim for quality over quantity. Focus on finding one great card with the features you need. After you've gotten the card you want and used it for several months, you can consider getting another if you think it has benefits that will be valuable for you.

Take it one card at a time and make sure you don't get more cards than you can manage. Like this page? Share it! The Motley Fool owns shares of and recommends Visa and Mastercard. The Motley Fool recommends Amex. The Ascent does not cover all offers on the market.

How TO - Scroll Back To Top Button

Editorial content from The Ascent is separate from The Motley Fool editorial content and is created by a different analyst team. The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. From The Motley Fool. Advertiser Disclosure We do receive compensation from some partners whose offers appear here.

Support links

Best Credit Cards for January Rating image, 4. High cash back. Apply Now. Compare this Card. Why Apply A clear cash-back leader with a laundry list of perks that reads like a novel. Read Full Review. An application must be submitted to the issuer for a potential approval decision. There's no signing up. And no limit to how much is matched. Redeem cash back any amount, any time.

Rewards never expire. Use your rewards at Amazon. Get an alert if we find your Social Security number on any of thousands of Dark Web sites. No annual fee. Highlights Earn cash back twice. To earn cash back, pay at least the minimum due on time. After that, the variable APR will be Click "Apply Now" to see the applicable balance transfer fee and how making a balance transfer impacts interest on purchases. Balance Transfers do not earn cash back.

Citi Flex Plan offers are made available at Citi's discretion. Why Apply A great pick for a one-card wallet. Top Perks: Big sign up bonus Unlimited 1. Earn unlimited 1. Why Apply A solid contender with a rich sign-up bonus and among best-in-class cash back for restaurants and entertainment. After the intro APR offer ends, Great for: U. Why Apply Highest cash back gas and U. Over 3 million more places in the U. Terms Apply. All transfers must be completed in first 4 months.

Rating image, 5. Why Apply Few can top this offer. Why Apply One of the most popular travel cards for many reasons. Why Apply Strikes a nice balance of high rewards and a big sign-up bonus with low fees. Rating image, 3. Why Apply A fit for occasional travelers, this card's most valuable perks are unlimited 1. Top Perks: 1. For example, if you earn 35, Miles, you get 70, Miles. The more you earn, the more you get.

Stow Back On Top

No Blackout Dates. Miles Pay You Back. Easily redeem Miles as a statement credit for travel purchases. Or get cash.

AZLyrics - request for access

Why Apply We've simply not found a better student credit card. This offer somehow includes premium rewards with no annual fee, along with a list of perks that reads like a novel Read Full Review. No late fee on first late payment. No APR change for paying late. Why Apply An unmatched leader with a laundry list of perks and focus on reducing pesky fees. Highlights No Annual Fee, earn cash back, and build your credit with responsible use. It's a real credit card. You can build a credit history with the three major credit bureaus.

Generally, debit and prepaid cards can't help you build a credit history. Bank information must be provided when submitting your deposit. Automatic reviews starting at 8 months to see if we can transition you to an unsecured line of credit and return your deposit. Why Apply A go-to credit card for people dipping their toes in to building their credit histories, mostly due to the card's low initial security deposit and no annual fee. Sign up to receive our weekly curated credit card articles, expert guides, and well-researched product offers to help you conquer your money goals!

What type of credit card is right for you?