An Overview. The Foreign Corrupt Practices Act of , as amended, 15 U.S.C. §§ 78dd-1, et seq. ("FCPA"), was enacted for the purpose of.

Table of contents

- An overview of the U.S. Foreign Corrupt Practices Act (FCPA)

- Navigation menu

- Email Updates

- Foreign Corrupt Practices Act - Wikipedia

For example, since , Avon Products, Inc.

An overview of the U.S. Foreign Corrupt Practices Act (FCPA)

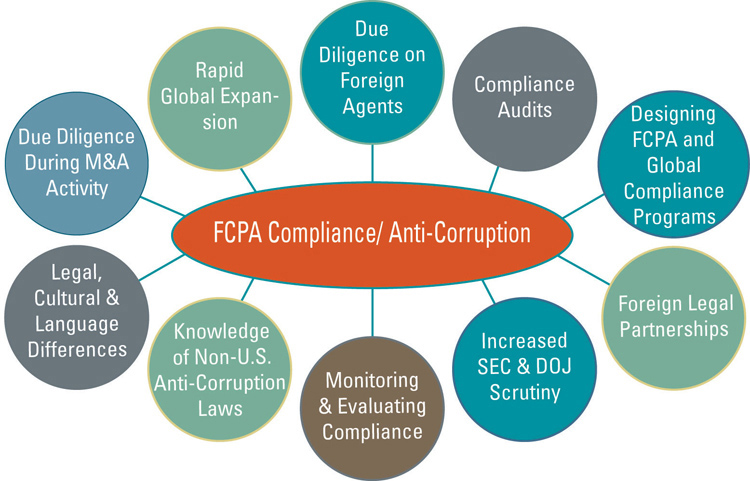

Given the increased enforcement of the FCPA and the duration and cost of investigations and related litigation, it is important that counsel for insurers and insureds are familiar with the law and the insurance coverage issues that may be implicated by FCPA investigations and related litigation. The accounting provisions also prohibit individuals and businesses from knowingly falsifying books and records or knowingly failing to implement internal controls. Anti-Bribery Provisions Generally, the anti-bribery provisions make it unlawful to offer, pay, promise to pay, or authorize payment of money, or to offer, give, or promise to give anything of value to a foreign official in order to obtain or retain business or secure an improper business advantage.

The anti-bribery provisions can apply to conduct both inside and outside the United States. Congress amended the FCPA in to expand its scope. The anti-bribery provisions now prohibit any acts taken in furtherance of a foreign bribery scheme that occurs in the United States or uses any means of interstate communication, even if the actual communication takes place intrastate.

For example, in United States v. Kay , the Fifth Circuit held that. Congress intended for the FCPA to apply broadly to payments intended to assist the payor, either directly or indirectly, in obtaining or retaining business for some person, and that bribes paid to foreign officials to secure illegally reduced customs and tax liability constitute a type of payment that can fall within this broad coverage.

Navigation menu

Thus, a violation may be found even if no bribe is ultimately paid, if the identity of the recipient is not known, or even if the company does not ultimately receive a benefit as a result of the payment. The intent to influence corruptly is sufficient. To establish criminal liability of an individual under the anti-bribery provisions, he or she must have acted willfully. An improper payment may be anything of value.

Email Updates

Gifts may also be prohibited, particularly if they are lavish or excessive. Likewise, foreign charitable contributions are not prohibited under the FCPA unless made for the purpose of improperly influencing a foreign official or made without a proper vetting of the foreign charity.

Further, an improper payment need not be made directly to a foreign official; payments to friends or family members of an official may also violate the FCPA, if made in order to influence the official. Who is a foreign official? Payments to third parties. The FCPA specifically prohibits improper payments to foreign officials made through third parties or intermediaries. There are two possible affirmative defenses under the anti-bribery provisions: No specific statute of limitations is provided for in the anti-bribery provisions of the FCPA; therefore, the general five-year limitations period applies to substantive criminal violations of the act.

The limitations period also may be extended by a tolling agreement, or the government may apply for an extension of up to three years in order to obtain evidence from foreign countries. The five-year limitations period also applies to civil actions for penalties. Again, the limitations period may be extended by a tolling agreement, and in cases involving foreign individuals, the limitations period is tolled for any period during which the individuals are not found within the United States.

There can be civil liability under the accounting provisions for both companies and individuals. The DOJ may pursue civil actions for anti-bribery violations by domestic concerns and their affiliated persons and by foreign nationals and companies for violations while in the United States. The SEC may pursue civil actions against issuers and their affiliated persons for violations of the accounting provisions. There also may be collateral consequences resulting from FCPA violations, including suspension or debarment from contracting with the federal government, cross-debarment by multilateral development banks such as the World Bank , and suspension or revocation of certain export privileges.

Insurance Coverage Issues Notice. Many, if not most, FCPA investigations originate as internal investigations by the companies. A company conducting an internal investigation should consider when it is appropriate or necessary to give notice to its insurer of a claim or potential claim.

The FCPA has expressly provided for two defenses: If you would like to learn how Lexology can drive your content marketing strategy forward, please email enquiries lexology. I particularly like the user-friendly format, which I find highly efficient! We use cookies to customise content for your subscription and for analytics.

Foreign Corrupt Practices Act - Wikipedia

If you continue to browse Lexology, we will assume that you are happy to receive all our cookies. For further information please read our Cookie Policy. Follow Please login to follow content. My saved default Read later Folders shared with you. Register now for your free, tailored, daily legal newsfeed service. An overview of the U. USA March 7 The FCPA has two main provisions. Issuers It includes any U.

- Search form.

- Foreign Corrupt Practices Act!

- Foreign Corrupt Practices Act | CRIMINAL-FRAUD | Department of Justice.

- Cuba and Its Music: From the First Drums to the Mambo.

Domestic concerns It refers to any individual who is a citizen, national or resident of the United States and any corporation and other business entity organized under the laws of the United States or any individual U. Any person It refers to both companies and individuals legal and natural persons. Popular articles from this firm An overview of the U.

- leondumoulin.nl | Foreign Corrupt Practices Act?

- Promises Reveal (Promise Series).

- No More Silly Love Songs: A Realists Guide to Romance?

- Rejuvenated Jewels: New Designs for Vintage Treasures!

- Whose Money Is It Anyway?: A Biblical Guide to Using Gods Wealth.