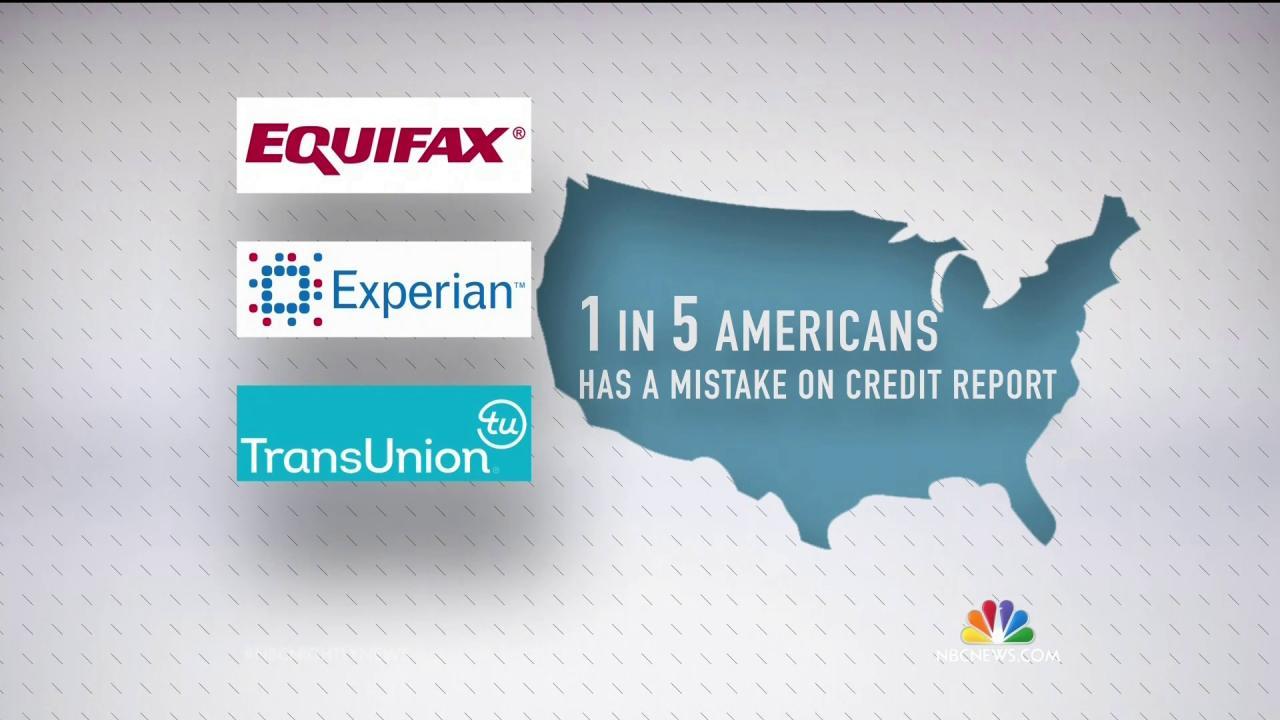

If you don't know your credit report, how do you know there is a mistake? Embrace the world of big data and financial technology to lower the.

Table of contents

- How to Check

- Credit rating agency - Wikipedia

- Complete List of Credit Reporting Agencies

- Access Denied

Attorney Sonya Smith-Valentine, credit reporting expert and author of the forthcoming book "How to Have a Love Affair with Your Credit Report" agrees, saying many people over worry about their reports.

Employers use credit checks to discriminate. According to Smith-Valentine, a driving force behind credit checks is litigation protection.

How to Check

Be aware though, that in the future, companies may even be prohibited from accessing your report at all if a bill currently in Congress -- the Equal Employment For All Act -- becomes law. The bill would amend the Fair Credit Reporting Act to limit employers' ability to check credit reports and to use them against prospective and current employees. All negative information is bad.

Some is more alarming than others. While a lender may balk at a skipped credit card payment, the Human Resource Management report found that employers are most negative about you being sued for a debt and that results in a monetary judgment a concern because there could be wage garnishments they would have to deal with Next worst?

Not paying your bills and having them land in collection. That did concern me, and ultimately we did not extend an offer. Large, outstanding balances can be adverse too. If their monthly payments are too big, "that's a sign of financial duress and a risk factor for committing financial exploitation. Employers don't care about your reasons for having bad credit. Prior to your credit report being checked and you'll know,as you have to give permission , disclose problems quickly.

I'm going to find out about it anyway, and if I feel that you are trying to hide it from me, then I am going to wonder what else you are hiding," says Desbarres. Solid explanations help, assures Desbarres.

Credit rating agency - Wikipedia

If you can give me a plausible explanation about why this derogatory information should not be a cause for concern, I'm more than happy to hear it. Remember, I've already made the decision that I want to hire you! Finally, if you have fabulous credit and are counting on it giving you an edge, forget about it. It's nice, but the candidate with the firmer handshake and superior credentials will probably join the payroll.

Features Luxury Business Leaders. Facebook Twitter Comments Print. This brings us back to that other downside to filing bankruptcy: It can be expensive. And no, those expenses cannot be discharged in the course of the bankruptcy. Nevertheless, if it allows you to eliminate most or all of your debt and get a fresh start, the costs may be worth it.

Complete List of Credit Reporting Agencies

Model Acceptance Industry adoption. Explore our model How to test your model. How it scores more people.

Tap our resources Articles. Model conversion webcast series. Industries we serve Bankcard. Did You Know… the truth about bankruptcy on credit reports?

Access Denied

In addition to content for lenders, would you also like to receive consumer content? Inside the latest issue. Model Acceptance Model Acceptance Industry adoption.